eNACH and eMandate

e-NACH stands for Electronic National Automated Clearing House.

E-NACH and e-Mandate are easier ways for merchants and their buyers to handle all recurring payments like telephone bills, insurance premiums, utility bills, SIPs, school fees etc.

For instance, if you are signing up for an insurance plan through an e-Mandate, you can schedule all your premium payments through a simple online process at the start of the insurance period, instead of manually keeping track and making individual premium payments. No more pesky reminders or late fees!

E-NACH & e-Mandate are new payment services that allow anyone with a bank account to easily automate recurring payments.

eNACH is the electronic process of helping the banks, financial institutions and other government bodies to provide automated payment services.

Once the user signs the eNACH or electronic NACH form, he gives permission to the concerned authority to debit the said amount from his bank every fixed day of the month.

There is no limit to the number of e-Mandates that can be set up for an account.

difference between e-NACH & e-Mandate?

They are two different services, both delivering the same result i.e. enabling automated recurring payments. e-NACH is governed by NPCI & covers over 40+ banks while e-Mandates are controlled by individual banks and is currently available across 4-5 banks.

how does the service work?

E-Mandates can be directly set up through a netbanking transaction from merchant websites. In order to do this, a customer would need to complete a one time netbanking transaction authorization after which all subsequent payments will not require customer intervention.

What happens in case of insufficient balance in the bank account?

Like any other online transaction, in times of insufficient balance, the payment to the merchant is denied.

How does the payment appear in the bank statement?

Payments will be reflected as NEFT Bank transfers from the customer account to merchant account.

e-NACH Process

e-NACH process has been set up to solve the above problems. With the advent of eNACH, the need to fill NACH form has been eliminated.

When using electronic NACH, the process can be completed within a few hours, since the entire system requires minimum human interaction and logistical dependency is very low.

eNACH utilizes the services of NPCI’s National Automated Clearing House (NACH), to attain its objectives.

Now, It has the following entities involved:

1.NPCI – National Payments Corporation of India is the regulatory body constituted by the Government of India to oversee all Retails payments in India. It was set up with the guidance and support of Reserve Bank of India (RBI) and Indian Banks’ Association (IBA).

2.Sponsor Bank – These are the banks’ empanelled with the NPCI for the purpose of facilitating eMandate process. There are currently 3 sponsor banks HDFC, HSBC and Punjab National Bank.

3.Destination Bank – Your bank where you hold the account from which you want the automatic debit to be made.

4.Corporate – The Company/Bank for which you have requested the eMandate so that they can auto-debit your bank account.

5.Customer – You are termed as the customer, since you are going to apply for the e-NACH through the Corporate.

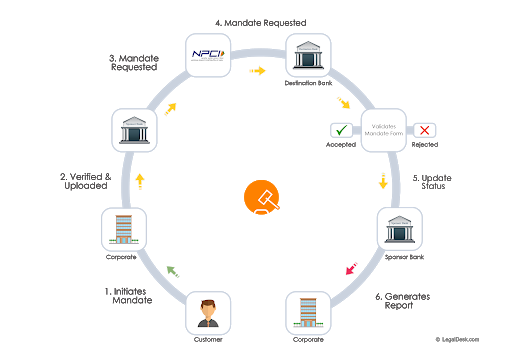

eMandate process workflow

The e-NACH/e-Mandate system assists in the issuance and confirmation of mandate by the customers through alternate channels to paper-based mandate.

The process is routed in a way that the destination bank, after authentication, moves the mandate to the sponsor bank or from the corporate to the sponsor bank and then to the destination bank, which includes the attributes of the customer.

- Creation of an authenticated mandate by the customer himself through electronic channels.

- Shorter mandate acceptance cycle or auto acceptance of mandates.

- Secured and assured mandate acceptance- mandates are initiated by the customer or his banker.

The primary objective of eNACH/eMandate is to reduce the burden of processing on the destination bank therefore all the aspiring participants on eMandate platform should implement end to end process automation including auto submission of authenticated mandates to NACH system.

NPCI reserves the right to allow participation in the eMandate process depending on the readiness of the bank to process with full automation.