ICICI BANK

KOTAK BANK

YES BANK

PAYTM PAYMENT BANK

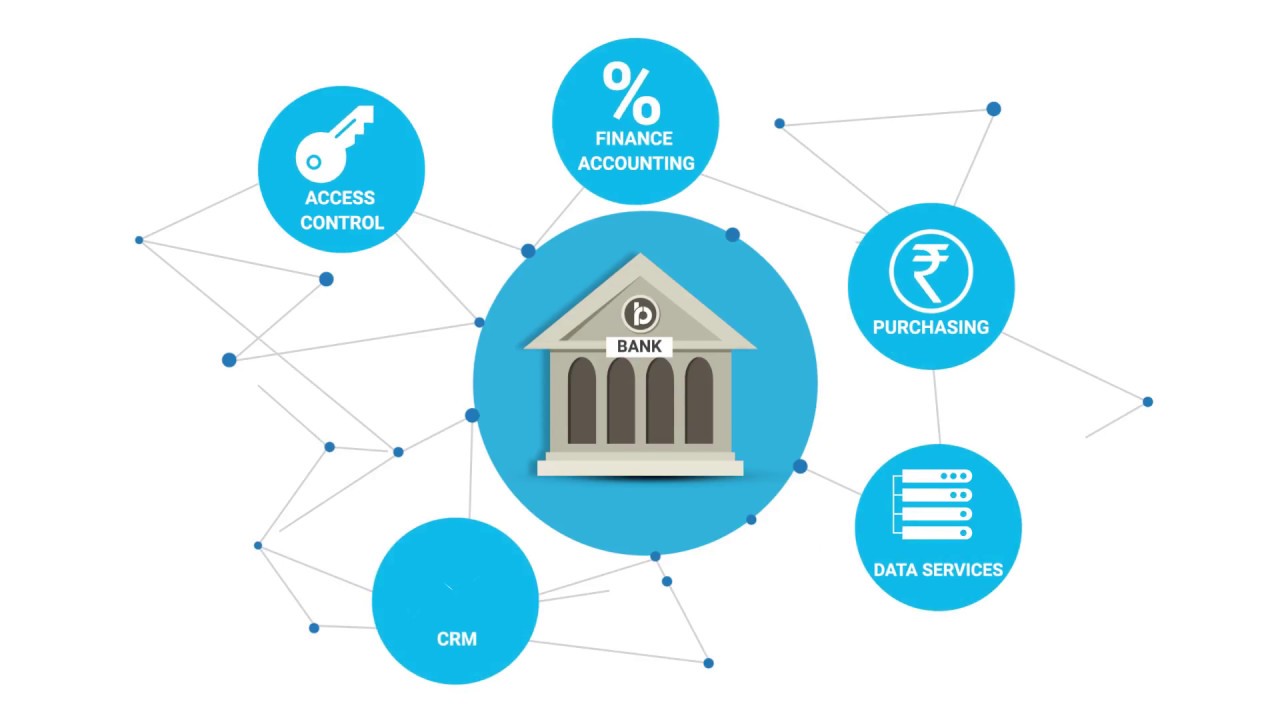

API Banking

Banking With The Technology Edge

API is the acronym for Application Programming Interface, which is a software intermediary that allows two applications to interact with each other. For example, each time you use an app like Facebook, send an instant message, or check the weather on your phone, you are using an API.

It serves as an interface between different software programs and facilitates their interaction, similar to the way the user interface facilitates interaction between humans and computers.

Bhim UPI Payment Collection via QR Code with ICICI Bank

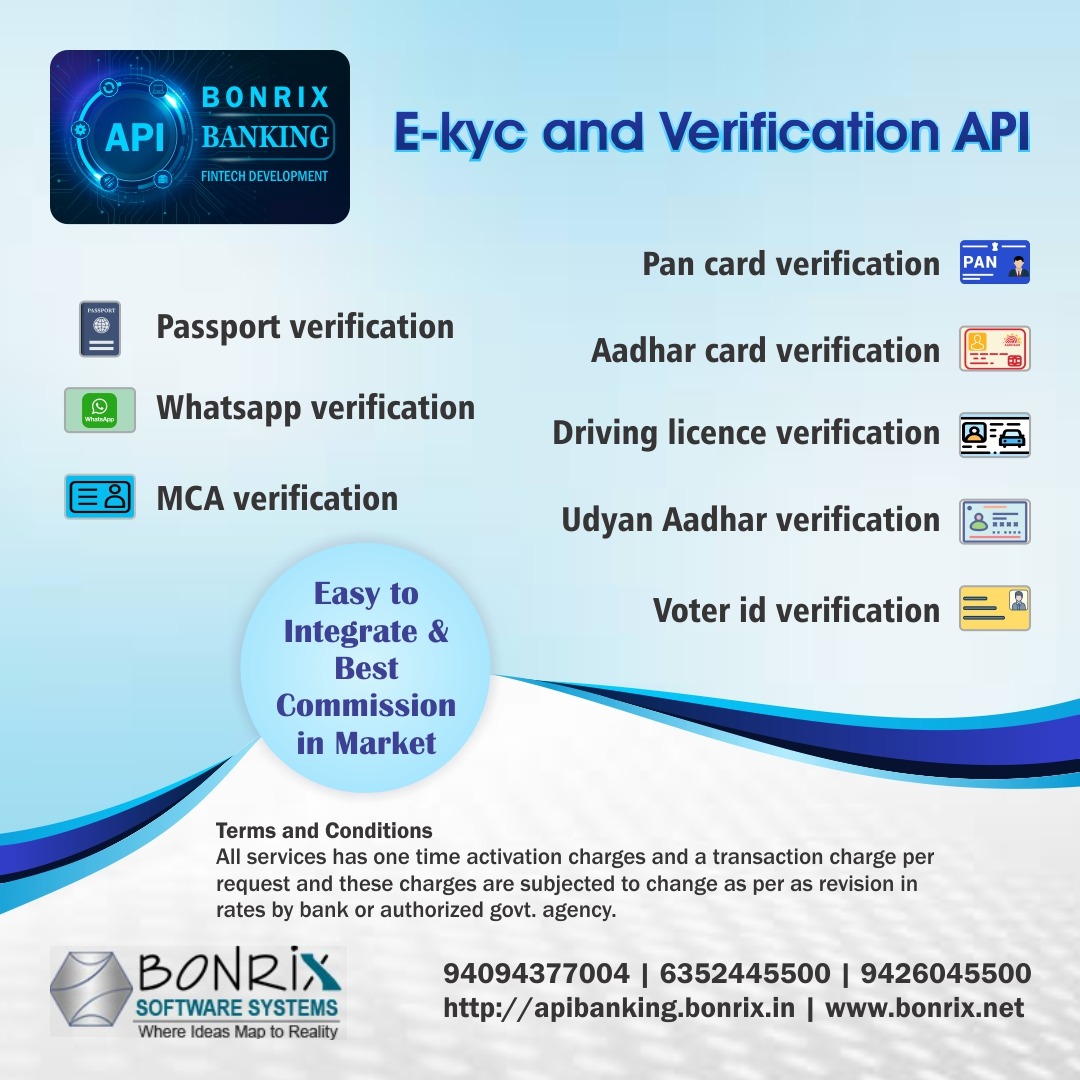

E-kyc and Verification API

• Pan card verification

• Aadhar card Verification

• Voter id Verification

• Driving licence Verification

API Integration & Business Platforms (B2B & B2C) Development Services

MicroATM, AEPS, Money Transfer*, Recharge, CMS, *Payment Gateway, _Dynamic QR Code (BHIM UPI)_*, PAN Card, *Aadhar Pay, *BBPS*

Bonrix Partners with Worldline Ingenico E-payments Pvt Ltd under Reseller Program to start Payment Gateway Integration

Settlement is in T+2, Supports all payment options by default, including Credit cards, Debit Cards, UPI, Netbanking, EMI, Wallets, and PayLater, Multiple currency acceptance and settlement.

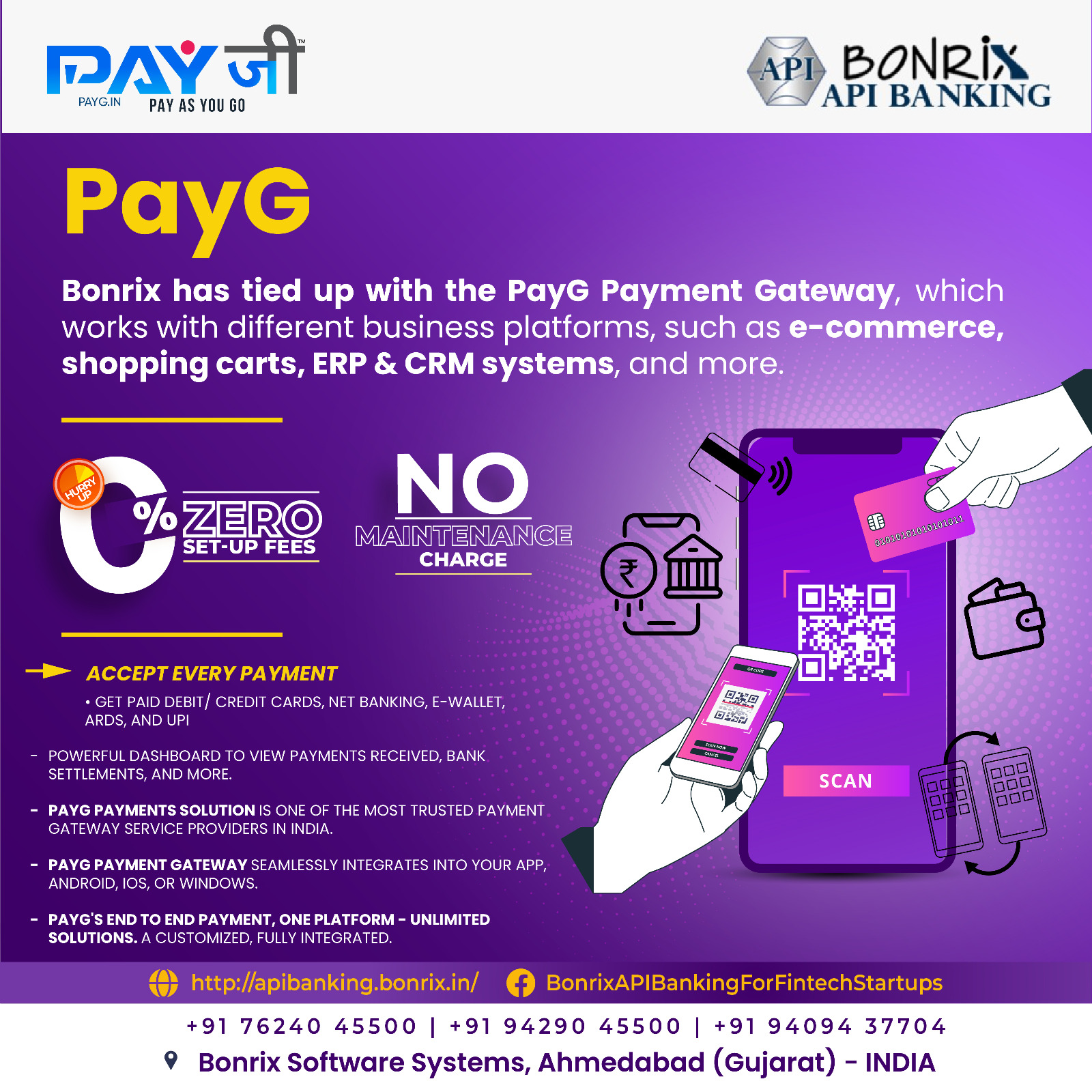

Bonrix API Banking PayG Payment Gateway Integration

We're elated to announce that Bonrix has now partnered with PayG Payment Gateway, one of India's most reputable payment service providers. This collaboration is set to revolutionize the way payments are managed and processed across different business platforms.

Bonrix partners with Fidpay to quick start Dynamic QR code based Payment Collections

(BHIM UPI Payment Gateway)

▪One time QR Code Generation and API activation charges

▪Settlement Period: T+1

▪Settlement Charges: almost ZERO

OPEN BANKING/ API BANKING

API Development Service for Fintech Startup Payment Collection BHIM UPI, Credit/ Debit Card Net Banking and Virtual Account

BBPS Integration Available

Gas Bill, Electricity Bill, Mobile Bill, Broadband Bill, DTH Bill, Landline Bill, Water Bill & Fastag Recharge.

Bonrix Api Banking payment gateway.

Bhim UPI Payment Collection via QR Code with ICICI Bank.

0% Payment Collection Charge

printable QR Code available

E-Commerce website integration

*one time activation and development Charges

Bonrix Api Banking payment gateway.

Bhim UPI Payment Collection via QR Code with ICICI Bank

0% Payment Collection Charge

printable QR Code available

E-Commerce website integration

*one time activation and development Charges

Bonrix Api Banking payment gateway.

For Third-party Software Solution like E-Commerce, Mobile Recharge and other Online Payment Collection Solutions.

Bhim UPI Payment Collection via QR Code with ICICI Bank

With Bonrix ICICI UPI Payment Collection Control Panel (Web Panel)

0% Payment Collection Charge

printable QR Code available

E-Commerce website integration

*one

time activation and development Charges

Bonrix Bonrix introduce new B2C Recharge Portal - "Open Recharge"

1. Recharge without Login

2. No Wallet System

3. Express Recharge Using QR code Scan

4. Instant Discount / Commision for Customers

5. Spot Refund on Recharge Failure

6. Powered by ICICI Bank BHIM UPI Collection

This portal is best as standby solution for retailer for express recharge and instant commission, Also good for customers who are using Google Pay, Phone Pe, Paytm etc. for Recharge but not getting any discount on it.

Bonrix and SubPaisa Collaborate to Offer Unified Payment Gateway Solutions

Bonrix API Banking provides seamless and secure payment gateway services to help businesses of all sizes manage transactions with ease.

With no hidden costs or maintenance fees, Bonrix ensures a reliable, cost-effective solution for your business payment needs.

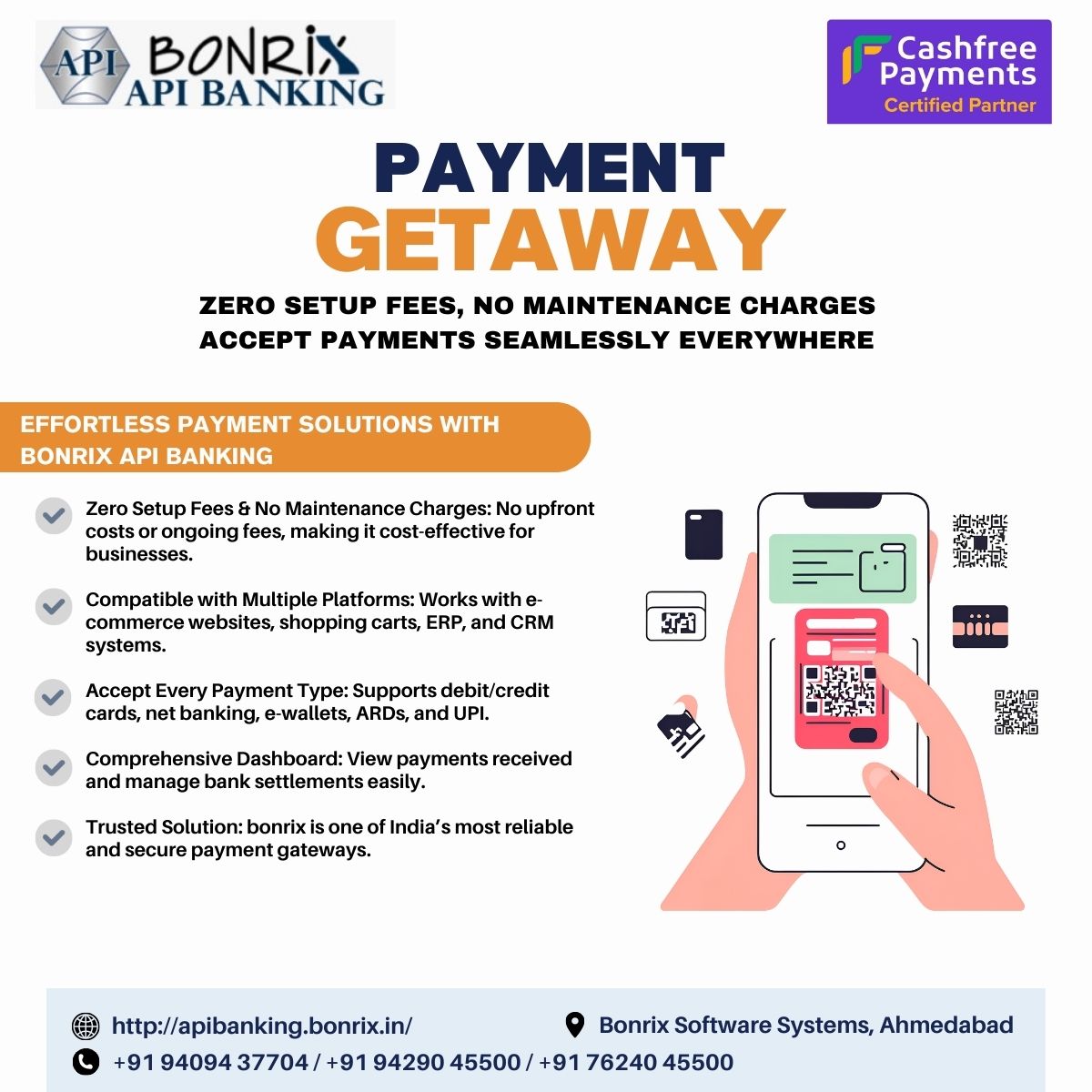

Bonrix Software Systems - Bonrix API Banking and Cashfree Payments Partner for Simplified Payment Gateway Integration

Bonrix API Banking offers seamless and secure payment gateway services, empowering businesses to manage payments efficiently without hidden costs.

Our platform is designed for flexibility, integrating with multiple systems to streamline your payment processes.

Now in partnership with Cashfree Payments, we provide an even more comprehensive and robust solution for businesses to grow confidently.

API Banking Solutions

Pay per use: A service based subscription that allows you to pay for what you use.

Flexibility: A flexible infrastructure with end-to-end capabilities.

Automated: A fully-automated banking services platform for your enterprise use.

Adaptable: Adaptable to the existing application and customizable to business needs.One time integration: it allows you;

- Control service level management

- Governance/monitoring.

- Reporting

- Capacity planning

Value added APIs: Value added APIs like eKYC, PAN verification API, Currency rates API, Credit score API etc., create one shop solution for API. It eliminates need to